Residence Mortgages Confusing You? Attempt These Tips Out

Content written by-Fink KrogsgaardFinding out that you could have gotten a much better mortgage than you currently have can be a very distasteful experience. You don't want to be that person. You want to go into a mortgage being well-informed. Therefore, keep reading so that you find out the information that you need to know.

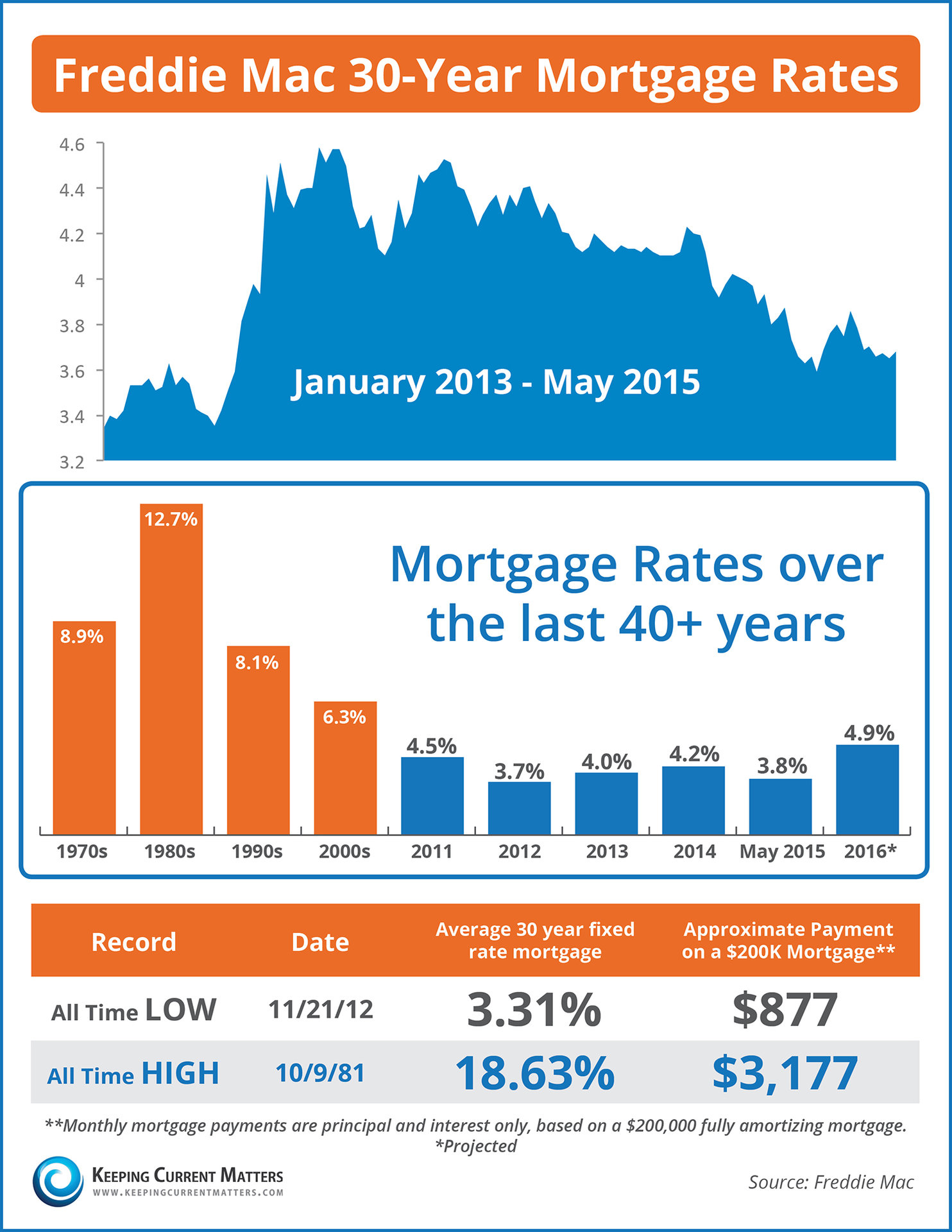

Don't put off a possible new mortgage any longer, or you're just wasting money. Chances are very good that with a new mortgage, you can pay a significantly lower amount of money every month. Look into additional Info , shop around, and then decide on the terms that will suit your budget well, and save you the most cash!

Don't spend too much as you wait for approval. Before the mortgage is final, lenders like to check credit scores again, and if they see a lot going on, they may reconsider. Wait until the loan is closed to spend a lot on purchases.

Know how much you can afford to put towards your home mortgage. Do not rely on the lender to tell you the amount you qualify for, causing you to borrow the maximum amount. Try planning your budget and leaving some room for unexpected expenses. This is usually the case when you buy a home. You can use banking calculators to determine how much you can afford on a home and provide an estimate of the monthly mortgage payments.

Always read the fine print before you sign a home mortgage contract. There are many things that could be hidden inside of the contract that could be less than ideal. This contract is important for your financial future so you want to be sure that you know exactly what you are signing.

Draw up a budget before applying for a home loan. It is important that you know how much you can realistically spend on a mortgage payment. If you aren't paying attention to your finances, it is easy to over-estimate how much you can afford to spend. Write down your income and expenses before applying for the mortgage.

Always read the fine print before you sign a home mortgage contract. There are many things that could be hidden inside of the contract that could be less than ideal. This contract is important for your financial future so you want to be sure that you know exactly what you are signing.

Don't forget to calculate closing costs when applying for a mortgage, particularly if this is your first time. Above and beyond the down payment, numerous charges exist simply for processing the loan, and many are caught off guard by this. You should anticipate paying up to four percent of the mortgage value in total closing costs.

Avoid paying Lender's Mortgage Insurance (LMI), by giving 20 percent or more down payment when financing a mortgage. If you borrow more than 80 percent of your home's value, the lender will require you to obtain LMI. LMI protects the lender for any default payment on the loan. https://www.horizont.net/schweiz/nachrichten/igemwemf-studie-neue-typologie-der-schweizer-mediennutzung-198515 is usually a percentage of your loan's value and can be quite expensive.

While you are in the process of getting a mortgage loan, do not apply for any new credit cards. Every time your credit is checked it puts a mark on your credit score. Too many of these will make it difficult on you if your credit is already a bit questionable.

Ask a lot of questions of the mortgage lender you plan to use. The lender should answer your questions clearly, without being vague. If a lender dodges your questions or refuses to give a straight answer, you know it's time to look for a new home mortgage lender to work with.

Make sure that you have a good amount of savings before you get yourself into a home mortgage contract. There are not certainties when it comes to the economy or job stability. To protect yourself you want to have enough money saved to make your payments for many months in case the worst does occur.

Before you even start looking at a new home to buy, try to get pre-approved for a home. This will give you confidence when looking for a new home and let you know what your budget is. It will also save you from choosing a home only to find out you cannot secure a large enough loan to purchase it.

Contrary to popular belief, there are plenty of lenders out there who will loan to you. So you need to shop around with your loan options. Never jump at the first opportunity you find. This will leave you paying far too much and will leave you obligated to a loan whose terms are not favorable to you.

Before applying for a home mortgage, get your debts in order. Consolidate small debts with high interest rates and put a solid effort into paying them off. Do not take on new debt while you are preparing to apply for a home mortgage. The cleaner your debt record when you apply for a home mortgage, the better your chances of getting approval for a good loan at a good rate.

Let your social circle know that you are trying to get a mortgage. Friends, family and even coworkers can be wonderful sources of referrals and first hand testimony as to who to use or avoid. Get online and seek out reviews and feedback from previous customers to get a feel for who is right for you.

Make sure that you compare mortgage rates from several companies before you settle on one. Even if the difference seems to be minimal, this can add up over the years. One point higher can mean thousands of extra you will have to shell out over the course of the loan.

One item of documentation for home mortgage application that is often overlooked is a gift letter. If your relatives have chipped in to help you make your down payment, you may need to document your source of income. This really depends on the type of home mortgage you get. Some require this, and others do not. Play it safe by getting a gift letter from anyone who gives you money to help you buy your home. Have this on file with your other documentation.

There are times when the seller of a home will be able to give you a land contract so you can purchase the home. The seller needs to own the home outright, or owe very little on it for this to work. A land contract may need to be paid within a few years.

Hopefully, these tips have taken some of the mystery out of the mortgage process. Maybe now it is time you took the plunge. Use these tips through the process. Now, all you have to do is go shopping for mortgages and remember what you learned here.